Of the life insurers, there are 1 government-owned and 31 privately-owned companies. Non-life Insurance, there are 1 public and 45 privately owned companies.

In today’s unpredictable world, having dependable insurance coverage is crucial. Whether it’s for health, life, vehicles, property, or business, insurance provides the financial security you need to navigate life’s surprises. In Bangladesh, the insurance industry has expanded significantly in the last ten years, presenting a variety of options from both life and general insurance providers.

But with so many options available, how do you choose the right one? In this article, we’ll take a closer look at the leading insurance companies in Bangladesh, known for their reliability, excellent customer service, and effective claim processing. Whether you’re looking to insure your life, belongings, or business, this list will assist you in making a well-informed choice based on their performance, reputation, and adherence to regulations.

Insurance is a contract. It is a legally binding agreement between two parties. A contract is entered into by one party promising to indemnify the other party. The other party enters into a contract promising to pay a premium at a fixed rate to receive compensation.

A contract between the first party insurer and the second party insured containing the assurance of payment of indemnity and payment of premium respectively. In case of life insurance loss is not covered, no value of human life can be quantified. Hence financial security is provided in life insurance.

Insurance industry plays a very important role in the economic development of any country. Insurance helps in capital formation by collecting small savings (premium) from the public. Guarantees compensation for human life, debt and property.

Having such assurance makes people feel secure in their workplace and can concentrate on work. As a result, personal productivity increases. Thus, if individual production increases, national production increases.

Top insurance companies in Bangladesh

When production increases, the standard of living of the people improves and the overall economic prosperity of the country. Example: Life insurance contract, fire insurance contract.

Life insurance

Life insurance is a financial agreement between you (the policyholder) and an insurance company, where the company promises to pay a lump sum of money (called the death benefit) to your chosen beneficiaries if you pass away during the term of the policy. In exchange, you pay regular premiums, either monthly, quarterly, or yearly.

“Life insurance premium” is the payment you pay to your life insurance company in exchange for your coverage. Life insurance premium can be regular monthly/annual payments or lump sum payments. Payments (called death benefits) are payments the life insurance company makes to your beneficiaries if you die unexpectedly during the term.

Here is your latest Bd life insurance list by the table.

| Company Name | Web Site |

|---|---|

| Alpha Islami Life Insurance | www.alphalife.com.bd |

| Baira Life Ins | www.bairalife.com |

| Best Life Insurance | www.bestlifebd.com |

| Chartered Life Insurance | www.charteredlifebd.com |

| Daimond Life Insurance | www.diamondlifebd.com |

| Delta Life Insurance | www.deltalife.com |

| Fareast Islami Life Insurance | www.fareastislamilife.com |

| Golden Life Insurance | www.goldenlife-insurance.com |

| Guardian Life Insurance | www.guardianlife.com.bd |

| Homeland Life Insurance | www.homelandlife.com |

| Jamuna Life Insurance | www.jamunalife.com |

| Jibon Bima Corporation | www.jbc.gov.bd |

| LIC Bangladesh | www.licbangladesh.com |

| Meghna Life Insurance | www.meghnalife.com |

| Mercentile Life Insurance | www.milil.com.bd |

| Metlife | www.metlife.com.bd |

| National Life Insurance | www.nlibd.com |

| NRB Global Life Insurance | www.nrbgloballife.com |

| Padma Islami Life Insurance | www.padmalife.com |

| Popular Life Insurance | www.popularlifeins.com |

| Pragati Life Insurance | www.pragatilife.com |

| Prime Islami Life Insurance | www.primeislamilifebd.com |

| Progressive Life Insurance | www.progressivelife.com.bd |

| Protective Islami Life Insurance | www.protectivelife.com.bd. |

| Rupali Life Insurance | www.rupalilife.com |

| Sandhani Life Insurance | www.sandhanilife.com |

| Sawdesh Life Insurance | www.swadeshlife.com |

| Sonali Life Insurance | www.sonalilife.com |

| Sunflower Life Insurance | www.sunflowerlife.com |

| Sunlife Insurance | www.sunlifeinsbd.org |

| Trust Islami Life Insurance | www.trustislamilife.com |

| Zenith Islami Life Insurance | www.zenithlifebd.com |

Non-Life Insurance

Non-life insurance, also known as general insurance, is a type of insurance that covers financial losses other than death. It provides protection for assets, property, health, liability, or travel, usually for a specific period.

Here is your latest Bd non-life insurance list by the table.

| Company/Corporation Name | Website |

|---|---|

| Agrani Insurance Company Limited | www.agraniins.com |

| Asia Insurance Limited | www.asiainsurancebd.com |

| Asia Pacific General Insurance Company Limited | www.apgicl.com |

| Bangladesh Co-operative Insurance Limited | www.bdcoopinsurance.com |

| Bangladesh General Insurance Company Limited | www.bgicinsure.com |

| Bangladesh National Insurance Company Limited | www.bnicl.net |

| Central Insurance Company Limited | www.cicl-bd.com |

| City General Insurance Company Limited | www.cityinsurance.com.bd |

| Continental Insurance Limited | www.cilbd.com |

| Crystal Insurance Company Limited | www.ciclbd.com |

| Desh General Insurance Company Limited | www.deshinsurancebd.com |

| Dhaka Insurance Limited | www.dhakainsurancebd.com |

| Eastern Insurance Company Limited | www.easterninsurancebd.com |

| Eastland Insurance Company Limited | www.eastlandinsurance.com |

| Express Insurance Limited | www.eilbd.com |

| Federal Insurance Company Limited | www.federalinsubd.com |

| Global Insurance Limited | www.globalinsurancebd.com |

| Green Delta Insurance Company Limited | www.green-delta.com |

| Islami Commercial Insurance Company Limited | www.iciclbd.com |

| Islami Insurance Bangladesh Limited | www.islamiinsurance.com |

| Janata Insurance Company Limited | www.janatainsurance.com |

| Karnaphuli Insurance Company Limited | www.kiclbd.com |

| Meghna Insurance Company Limited | www.micl.com.bd |

| Mercantile Insurance Company Limited | www.mercantileins.com |

| Nitol Insurance Company Limited | www.nitolinsurance.com |

| Northern Islami Insurance Limited | https://niil.com.bd/ |

| Paramount Insurance Company Limited | www.paramountinsurancebd.com |

| Peoples Insurance Company Limited | www.peoplesinsurancebd.com |

| Phoenix Insurance Company Limited | www.phoenixinsurance.com.bd |

| Pioneer Insurance Company Limited | www.pioneerinsurance.com.bd |

| Pragati Insurance Limited | www.pragatiinsurance.com |

| Prime Insurance Company Limited | www.prime-insurance.net |

| Provati Insurance Company Limited | www.provati-insurance.com |

| Purabi General Insurance Company Limited | www.purabiinsurance.com |

| Reliance Insurance Limited | www.reliance.com.bd |

| Republic Insurance Company Limited | www.riclbd.com |

| Sadharan Bima Corporation | www.sbc.gov.bd |

| Sena Kalyan Insurance Company Limited | www.senakalyanicl.com |

| Sikder Insurance Company Limited | www.sikderinsurance.com |

| Sonar Bangla Insurance Limited | www.sonarbanglains.com |

| South Asia Insurance Company Limited | www.southasiainsurance.com |

| Standard Insurance Limited | www.standardinsurance.com.bd |

| Takaful Islami Insurance Limited | www.takaful.com.bd |

| Union Insurance Company Limited | www.unioninsurancebd.com |

| United Insurance Company Limited | www.unitedinsurance.com.bd |

Why You Need Life Insurance in Bangladesh

Life insurance is really important in Bangladesh for several economic, social, and family reasons. In a place where a lot of families depend on just one person to earn money, having life insurance can offer vital financial security and help ensure long-term stability.

Top Reasons to Get Life Insurance in Bangladesh

1. Family Financial Protection

If you’re the main income earner, life insurance ensures your family can manage daily expenses, school fees, and living costs even after you’re gone.

2. Debt & Loan Coverage

Life insurance helps pay off home loans, personal loans, or business debts so your family doesn’t inherit your financial burdens.

3. Child’s Education & Future Planning

Policies like endowment or savings-linked insurance can secure funds for your child’s education, marriage, or other future needs.

4. Affordable Premiums

In Bangladesh, life insurance policies are relatively affordable, especially if started at a young age. Many local companies offer flexible plans for different income groups.

5. Tax Benefits

Premiums paid for life insurance in Bangladesh may be eligible for tax deductions under certain conditions, helping reduce your overall tax burden.

6. Peace of Mind

Knowing your loved ones are protected brings emotional peace, especially in uncertain times due to health issues, natural disasters, or accidents.

7. Investment + Protection

Some life insurance plans in Bangladesh act as a dual benefit — providing life coverage and building savings or returns over time.

Life Insurance Is Especially Helpful For:

- Private and government job holders

- Small business owners

- Migrant workers supporting families back home

- Parents with school-going children

- Individuals with home or car loans

Latest Gazettes about law

last 27 june 2019 Insurance Development & Regulatory Authority (IDRA) published there latest gazzettes about there law. you can see this just one click.

Latest Gazettes about Acts & Rules

Insurance Development & Regulatory Authority (IDRA) published there latest acts & rule last 3 february 2019. you can know about this click here.

Thanks for reading our article Top insurance companies in Bangladesh with full facilities. If you have more information’s about it pls comment us bellow. People also searching- BD insurance companies list, insurance company list in Bangladesh, top insurance companies in Bangladesh, Bangladesh insurance companies name list, private insurance companies in Bangladesh, govt insurance companies in Bangladesh, general insurance companies in Bangladesh, life insurance companies in Bangladesh, best insurance company in Bangladesh, top 10 insurance companies in Bangladesh

BD insurance companies list, insurance company list in Bangladesh, top insurance companies in Bangladesh, Bangladesh insurance companies name list, private insurance companies in Bangladesh, govt insurance companies in Bangladesh, general insurance companies in Bangladesh, life insurance companies in Bangladesh, best insurance company in Bangladesh, top 10 insurance companies in Bangladesh

]]>Getting married is one of the most unforgettable and important milestones in life, yet it also brings along financial obligations. From wedding ceremonies to receptions, and gifts to travel – the costs can accumulate rapidly. For numerous couples in Bangladesh, securing a marriage loan has emerged as a favored way to handle these expenses.

However, prior to applying, it’s crucial to grasp the marriage loan interest rate in BD and how various banks and financial institutions organize their offerings. In this article, we will delve into the current interest rates, available loan options, eligibility requirements, and the top banks offering marriage loans in Bangladesh, assisting you in making a financially wise choice for your special day.

Thinking of marriage But the lack of money does not dare. Or with the money, you can not organize well. But such a time comes once in a lifetime. Then this report can bring good news to you. Several banks in Bangladesh have launched marriage loans.

Marriage Loan Interest Rate in BD

Here are your top Bangladeshi bank marriage loans or weeding loan interest rates. Most of the banks give marriage loans under personal loans.

You can get a loan from all the banks if you want. You must meet certain conditions, however. Today’s report contains all that information.

| Bank Name | Max Loan | Max Duration | Interest |

|---|---|---|---|

| Trust Bank | 10 Lakhs | 5 years | 13% |

| IFIC Bank | 3 Lakhs | 3 years | 16% |

| Bank Asia | 10 Lakhs | 5 years | 13% |

| Prime Bank | 20 lakhs | 5 years | 12-15% |

| City Bank | 20 lakhs | 5 years | |

| Standard Chartered | 10 lakhs | 5 years | |

| HSBC Bank | 10 lakhs | 5 years | 19% |

| Dutch Bangla | 10 lakhs | 5 years | 17.5% |

| Eastern Bank | 10 lakhs | 5 years | 15% |

Marriage Loan Details

Now I will tell you Marriage Loan Interest Rate Details. In this case, the bank’s decision will be final. To meet the need for marriage, a number of private banks have launched ‘marriage loans’.

These are – Prime Bank, Bank Asia, IFIC Bank, Trust Bank, ECSBC Bank, Dutch-Bangla Bank, Eastern Bank, City Bank, and Standard Chartered Bank.

Trust Bank

Trust Bank Limited is one of the leading private commercial banks having a spread network. The bank, sponsored by the Army Welfare Trust (AWT), is first of its kind in the country.

- Loan Limit: 50 Thousand to 20 Lac.

- Interest Rate: 13%

- Tenor: 1 year – 5 Years

- Minimum Down Payment: 50%

- Segments: Salaried Executives, Businessperson, & Self-employed professionals (Landlord/ Landlady, Architect, Engineer, Consultant, etc.)

- Age: Min. 25 years to Max. 65 years or up to retirement age.

IFIC Bank

To meet your marriage ceremony financial requirement of your IFIC Bank is here with a Personal loan. Whatever your requirement Personal Loan is the solution.

- Loan Limit: 50 Thousand to 10 Lac.

- Interest Rate: 16%

- Tenor: 1 year – 5 Years

- Minimum Down Payment: 50%

- Segments: Salaried Executives, Businessperson, & Self-employed professionals (Landlord/ Landlady, Architect, Engineer, Consultant, etc.)

- Age: Min. 25 years to Max. 65 years or up to retirement age.

Bank Asia

Bank Asia has been launched by a group of successful entrepreneurs with recognized standing in the society.

The management of the Bank consists of a team led by senior bankers with decades of experience in national and international markets.

- Loan Limit: 10 Lac.

- Interest Rate: 13%

- Tenor: 1 year – 5 Years

- Minimum Down Payment: 50%

- Segments: Salaried Executives, Businessperson, & Self-employed professionals (Landlord/ Landlady, Architect, Engineer, Consultant, etc.)

- Age: Min. 25 years to Max. 65 years or up to retirement age.

Prime Bank

Prime Bank offers all kinds of Commercial Corporate and Personal Banking services covering all segments of society within the framework of Banking Company.

Diversification of products and services include Corporate Banking, Retail Banking, and Consumer Banking right from industry to agriculture and real state to software.

- Loan Limit: 20 Lac.

- Interest Rate: 12-15%

- Tenor: 1 year – 5 Years

- Minimum Down Payment: 50%

- Segments: Salaried Executives, Businessperson, & Self-employed professionals (Landlord/ Landlady, Architect, Engineer, Consultant, etc.)

- Age: Min. 22 years to Max. 65 years.

City Bank Limited

The City Bank is a Bangladeshi private commercial bank, operating throughout Bangladesh. It is one of the few banks in Bangladesh with centralized infrastructure.

- Loan Limit: 1 Lac to 20 Lac.

- Interest Rate: 12-15%

- Tenor: 1 year – 5 Years

- Minimum Down Payment: 50%

- Segments: Salaried Executives, Businessperson, & Self-employed professionals.

- Age: Min. 22 years to Max. 60 years.

- Salaried Executive: Monthly 20,000 Tk.

Conclusion

Marriage loans can be a sensible option for couples or families looking to plan a wedding without putting too much strain on their savings. However, it’s essential to understand the marriage loan interest rate in BD before making any financial commitments. Interest rates can differ depending on the bank, the loan amount, the repayment period, and the applicant’s credit history. By comparing various banks and selecting the one with the best terms, you can alleviate financial stress and concentrate on enjoying this special occasion in your life.

Always take the time to read the loan terms thoroughly, evaluate your ability to repay, and choose a plan that aligns with your financial circumstances. Making a wise loan choice today can pave the way for a worry-free beginning to your new adventure.

Thank you for reading our article Marriage Loan Interest Rate in BD. If you have more information’s about that pls comment us bellow. People also searching – Marriage Loan compare, Marriage Loan Interest Rate compare, Marriage loan rate, Marriage loan interest rate in BD, Marriage loan in Bangladesh, Wedding loan interest rate BD, Best marriage loan in Bangladesh.

]]>In today’s globalized world, sending or receiving money across borders has become a regular necessity—especially for people living abroad, businesses, and freelancers. If you’re in Bangladesh or dealing with Bangladeshi banks, one essential code you must know is the SWIFT code. This unique identifier helps banks around the world recognize each other during international transactions.

Whether you’re receiving payments from overseas, sending funds to a foreign account, or conducting business globally, knowing the correct BD Bank SWIFT code is crucial. In this blog, we’ll guide you through everything you need to know about SWIFT codes in Bangladesh—including how they work, how to find them, and the complete list of SWIFT codes for all major banks in the country.

Not only that here is your all information about the swift code checker. Let’s enjoy.

BD Bank Swift Code

| Bank Name | Swift Code |

|---|---|

| AB Bank Limited | ABBLBDDH |

| Agrani Bank Limited | AGBKBDDH |

| Al-Arafah Islami Bank Limited | ALARBDDH |

| Bangladesh Commerce Bank Limited | BCBLBDDH |

| Bangladesh Development Bank Limited | BDDBBDDH |

| Bangladesh Krishi Bank | BKBABDDH |

| Bank Alfalah Limited | ALFHBDDH |

| Bank Asia Limited | BALBBDDH |

| BRAC Bank Limited | BRAKBDDH |

| Citibank N.A | CITIBDDX |

| City Bank Limited | CIBLBDDH |

| Commercial Bank of Ceylon Limited | CCEYBDDH |

| Dhaka Bank Limited | DHBLBDDH |

| Dutch-Bangla Bank Limited | DBBLBDDH |

| Eastern Bank Limited | EBLDBDDH |

| Exim Bank Limited | EXBKBDDH |

| First Security Islami Bank Limited | FSEBBDDH |

| Habib Bank Limited | HABBBDDH |

| ICB Islamic Bank Limited | BBSHBDDH |

| IFIC Bank Limited | IFICBDDH |

| Islami Bank Bangladesh Limited | IBBLBDDH |

| Jamuna Bank Limited | JAMUBDDH |

| Janata Bank Limited | JANBBDDH |

| Meghna Bank Limited | MGBLBDDH |

| Mercantile Bank Limited | MBLBBDDH |

| Midland Bank Limited | MDBLBDDH |

| Modhumoti Bank Limited | MODHBDDH |

| Mutual Trust Bank Limited | MTBLBDDH |

| National Bank Limited | NBLBBDDH |

| National Bank of Pakistan | NBPABDDH |

| NCC Bank Limited | NCCLBDDH |

| NRB Bank Limited | NRBDBDDH |

| NRB Commercial Bank Limited | NRBBBDDH |

| NRB Global Bank Limited | NGBLBDDH |

| One Bank Limited | ONEBBDDH |

| Padma Bank Limited | FRMSBDDH |

| Prime Bank Limited | PRBLBDDH |

| Pubali Bank Limited | PUBABDDH |

| Rupali Bank Limited | RUPBBDDH |

| Shahjalal Islami Bank Limited | SJBLBDDH |

| Social Islami Bank Limited (SIBL) | SOIVBDDH |

| Sonali Bank Limited | BSONBDDH |

| South Bangla Agriculture & Commerce Bank Limited | SBACBDDH |

| Southeast Bank Limited | SEBDBDDH |

| Standard Bank Limited | SDBLBDDH |

| Standard Chartered Bank | SCBLBDDX |

| State Bank of India | SBINBDDH |

| HSBC Limited | HSBCBDDH |

| Premier Bank Limited | PRMRBDDH |

| Trust Bank Limited | TTBLBDDH |

| Union Bank Limited | UBLDBDDH |

| United Commercial Bank Limited (UCB) | UCBLBDDH |

| Uttara Bank Limited | UTBLBDDH |

| Woori Bank | HVBKBDDH |

What is a Swift Code

In the era of digital finance and global connectivity, transferring money internationally has become faster and easier than ever. Whether you’re sending funds to a family member abroad or receiving international business payments, one key element that ensures your money reaches the right place is the SWIFT code.

But what exactly is a SWIFT code, and why is it so important? In this article, we’ll break down everything you need to know about SWIFT codes, how they work, where to find them, and why they matter in global banking.

A SWIFT code—also known as a Bank Identifier Code (BIC)—is an internationally recognized code used to identify specific banks and financial institutions during international transactions. It ensures that money is transferred to the correct bank in the correct country.

The term SWIFT stands for Society for Worldwide Interbank Financial Telecommunication, the organization that maintains the network used for secure and standardized communication between banks.

Swift code meaning Society for Worldwide Interbank Financial Telecommunication code. Swift is one of the most important transactions of a bank.

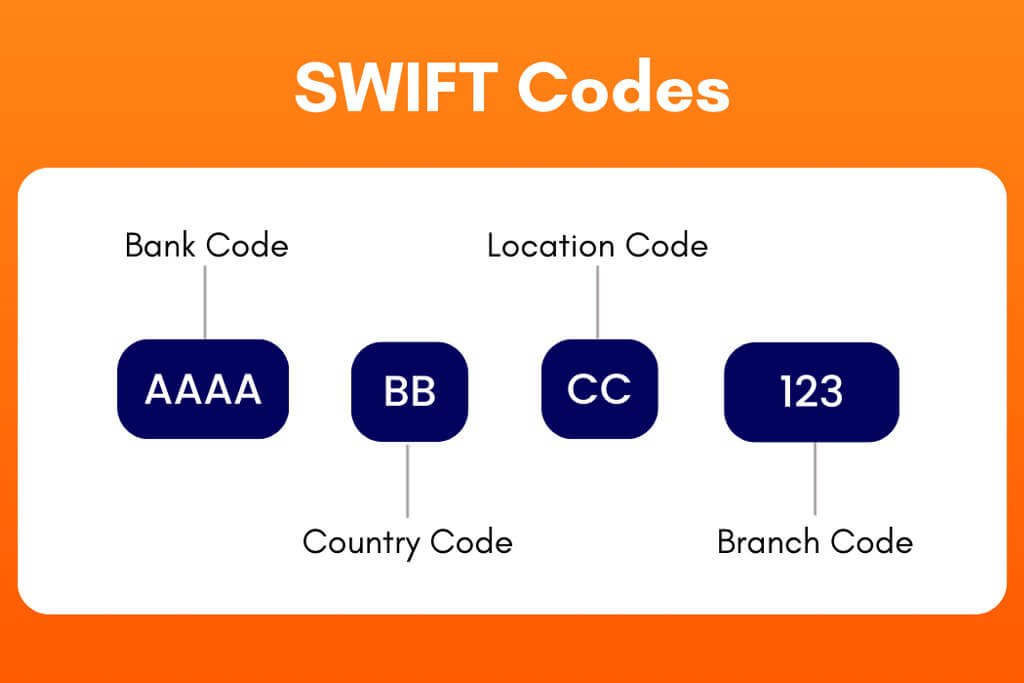

Structure of a SWIFT Code

This code consists of 8 or 11 characters. When 8 characters code is given, it refers to the primary office. When you want with branch code it will be 11 characters. Example is-

AAAA BB CC DDD

- First 4 characters – bank code (letters only)

- Next 2 characters – ISO 3166-1 alpha-2 country code (letters only)

- Next 2 characters – location code (letters and digits) (passive participant will have “1” in the second character)

- Last 3 characters – branch code, optional (‘XXX’ for primary office) (letters and digits)

Why is a SWIFT Code Important?

- Ensures international transactions reach the correct bank

- Required for wire transfers and remittances

- Used by banks worldwide to communicate payment instructions securely

- Avoids delays, rejections, and errors in international banking

Without the correct SWIFT code, your transfer may be delayed or even rejected.

Thank you for reading our article. If you have more info about it you can comment us bellow. People also searching – BD bank SWIFT code, Bangladesh bank SWIFT code, SWIFT code for all banks in Bangladesh, SWIFT code list Bangladesh, Bank SWIFT code Bangladesh, Bangladesh bank branch SWIFT code, SWIFT code lookup Bangladesh, International bank transfer SWIFT code BD, SWIFT code finder BD, SWIFT code for remittance in Bangladesh

]]>Gold loans are secured loans where gold jewelry is used as collateral. You pledge your gold jewelery to your lender and get a loan. The loan amount is usually a percentage of the value of the gold. You can repay the loan in monthly installments.

After payment, you will get your gold jewelry back. State-owned banks, private banks, and other financial institutions offer these loans at affordable interest rates. Generally, borrowers use this loan to meet sudden financial needs like marriage or child’s education. Instead of selling gold, many individuals opt for a loan option.

You take your gold jewelry to a lender and ask for a loan by pledging it. The lender evaluates the gold and approves the loan after verifying the documents. Some gold loan lenders even appraise your gold jewelry at home. The process is quick and usually takes a day.

For a gold loan, you need to submit identity proof like driving license, PAN, passport or Aadhaar card. If you don’t have PAN, you may be asked to submit Form 60. As proof of address, you need to submit an electric bill, ration card or telephone bill. You will also need to submit a signature proof like passport copy, driving license or any other document.

Along with these, you also need to provide a passport size photograph. Some lenders may also ask for proof of your income.

Gold Loan Interest Rate in Bangladesh

In times of financial need, gold loans have become a trusted and convenient solution for many individuals in Bangladesh. With minimal documentation, quick approval, and the security of pledged gold ornaments, these loans offer a hassle-free way to access cash without selling off your precious assets. One of the most important factors to consider when taking a gold loan is the interest rate, which directly impacts your repayment amount.

In this blog post, we’ll explore the current gold loan interest rates in Bangladesh, how they compare with other loan types, what factors influence the rates, and how you can secure the best possible deal. Whether you’re planning to fund a medical emergency, cover educational expenses, or support a business, understanding gold loan interest rates will help you make smarter financial decisions.

Gold Loan Rates (Jan–Mar 2025 averages)

- Minimum: 8.80% per annum

- Maximum: 19.60% per annum

- Mean: 13.79% per annum

This indicates typical gold loan interest in Bangladesh hovers around 13.8%, but individual bank offerings can vary significantly depending on the borrower’s profile, loan tenure, and bank policies.

General Lending Rates – Context for Comparison

Bangladeshi banks currently charge between 15%–16% for private-sector loans, placing gold loans slightly below usual loans in terms of interest. The central bank’s policy rate is around 10%, with commercial banks’ scheduled lending rates averaging 12–15% .

What This Means for You

- Benchmark: Use the ~13.8% mean rate as a reference when comparing offers.

- Shop Around: Some banks may offer gold loans lower than 10%, while others charge up to nearly 20%.

- Loan-to-Value & Tenure: Higher LTV ratios or longer repayment terms might lead to higher interest.

- Bank-Specific Deals: Banks like Bandhan Bank publish their own rate band – use these publicly available ranges for negotiation leverage.

Tips When Looking for Gold Loan Offers

- Compare multiple banks—look for lower rates and reasonable processing fees.

- Understand eligibility criteria—purity of gold, margin requirements, and loan tenure affect the rate.

- Watch for hidden fees—appraisal charges, insurance, or renewal fees can add to cost.

- Negotiate—knowing the average (13.8%) gives you leverage to seek better deals.

Quick Summary Table

| Feature | Value |

|---|---|

| Avg. Gold Loan Rate | ≈ 13.79% p.a. |

| Min–Max Range (Bandhan) | 8.8 % – 19.6 % p.a. |

| Bank Lending Rate Range | ≈ 15 – 16 % p.a. |

| Central Bank Policy Rate | ≈ 10 % p.a. |

Next Steps

- Reach out to major banks (e.g., Bandhan, Brac, Mutual Trust) for current gold loan rate offerings.

- Ask for a written quote detailing interest, tenure, LTV, and all associated fees.

- Carefully compare total repayment costs—not just interest rates—to find the best value.

More About Gold Loan Interest Rate

Since gold loans are secured loans, the interest rates are slightly lower than unsecured loans like personal loans. Non-banking financial companies (NBFCs) may charge higher interest rates than banks. Hence, it is advisable to compare various interest rates before taking a gold loan. This is a personal loan, with an interest rate of 12.75% or higher, although it varies between different lenders.

When you apply for a loan, the lender may charge a processing fee of up to 1% of the loan amount. You may also be charged for documentation. Fees may also apply for gold valuation. Lenders may charge a renewal fee based on the loan amount, and stamp duty as per state laws. You may have to pay late fees for late payments.

Depending on whether you decide to repay the loan, your lender may charge you service tax (or GST) and prepayment/early closing fees. The actual amount of the charge may vary from one lender to another. So, don’t forget to compare them as well. Anyone who owns gold jewelery can avail a gold loan. He may be a salaried person or a homemaker and farmer.

Gold loan tenure is usually short and it is usually between 3-12 months. However, some lenders offer relatively longer terms. Other lenders allow you to renew and extend your loan. Since the tenure is short, you must be sure that you can repay the loan on time. If you fail to repay the loan within the term, you may lose the mortgaged gold or the lender may sell it at auction to recover the loan amount.

Lenders assess the purity of gold and its weight before confirming the loan amount. Based on the purity and weight of the gold, the gold appraiser determines the market price. Lenders offer loans up to 75% of market value. This is called ‘loan to value ratio/LTV’.

The method of storing gold jewelry may differ from lender to lender, but proper measures are taken to properly store gold jewelry. After the loan is sanctioned and disbursed, the gold is kept under strict security.

Lenders use electronic vaults with motion detectors and CCTV for security. Some lenders even insure your mortgaged gold. This protects the gold from being stolen. In case of a robbery, you will get a refund equal to the market value of the gold.

Depending on your lender, you may have flexible repayment options. Most lenders offer you the option of paying only the interest portion every month. In such cases, the principal loan amount is repaid at the end of the loan tenure. You can also choose to pay EMIs to repay the loan.

Some Frequently Asked Questions (FAQ)

- Loan against Gold is a secured overdraft (SOD) facility by pledging Gold Jewelries/ornaments

- Any female customer ages between 18 to 65 years and owns.

- Gold jewelries/ornaments of purity 18 Carat & above.

- Loan can be offered against Gold Jewelries/ornaments owned by immediate family members subject to submission of ownership & relationship proof documents.

- Loan against Gold bar, Gold coin, bullion/primary Gold Gold-plated metals and other ornaments made of diamond, silver, cadmium etc. will not be accepted.

- Maximum 50% of the market value of pure Gold.

- Minimum limit is BDT 1,00,000 and maximum limit is BDT 5,00,000 or up to 50% of LTGV (whichever is lower).

- Portion of pure Gold is determined by excluding weight of stones, gems, khad and other metals from the gross weight.

Conclusion

Gold loans in Bangladesh offer a quick and reliable way to meet urgent financial needs without liquidating your assets. However, the interest rate is a key factor that directly affects the overall cost of the loan. As we’ve seen, gold loan interest rates in Bangladesh can vary from one bank to another, ranging from competitive rates as low as 8.8% to higher brackets nearing 19%.

Before choosing a lender, it’s essential to compare rates, understand the loan-to-value ratio, and consider additional fees or hidden charges. By doing your research and asking the right questions, you can secure a gold loan that’s not only convenient but also financially sound.

Whether you’re planning for a medical emergency, business investment, or educational expense, a gold loan can be a practical solution—just be sure to choose the right rate and repayment plan to make it work in your favor.

Thank you for reading Gold Loan Interest Rate. If you have more information about Gold Loan Interest Rate pls comment us bellow. People also searching – Gold loan interest rate in Bangladesh, Gold loan rate Bangladesh, Bangladesh gold loan interest 2025, Gold loan bank interest rate BD, Best gold loan rates in Bangladesh, Current gold loan interest rate BD

]]>Among them, Padma Bridge has introduced Bangladesh to the world in a new way. There are all the more important bridges like Jamuna, Lalon Shah, Amanat Shah. Today’s report is about 10 important bridges in Bangladesh.

Economically Important Bridges in Bangladesh

| Bridge Name | Length | Opened | District |

|---|---|---|---|

| Padma Multipurpose Bridge | 6,150 m | 2022 | Munshiganj |

| Jamuna Multipurpose Bridge | 4,987 m | 1998 | Sirajganj |

| Hardinge Bridge | 1,800 m | 1915 | Khulna |

| Lalon Shah Bridge | 1,786 m | 2004 | Rajshahi |

| Mukterpur Bridge | 1,521 m | 2008 | Munshiganj |

| Bekutia Bridge | 1,493 m | 2022 | Pirojpur |

| Payra Bridge | 1,470 m | 2021 | Patuakhali |

| Khan Jahan Ali Bridge | 1,360 m | 2005 | Khulna |

| Sayed Nazrul Islam Bridge | 1,194 m | 2002 | Kishoreganj |

| Shah Amanat Bridge | 950 m | 2010 | Chittagong |

Padma Bridge

Padma Multipurpose Bridge is a multipurpose road-rail bridge across the Padma River, the main distributary of Ganges, under construction in Bangladesh. It connects to Shariatpur and Madaripur, linking the south-west of the country, to northern and eastern regions. The bridge is scheduled for inauguration on 25 June 2022.

The bridge with 150.12 m (492.5 ft) long 41 spans, 6.150 km (3.821 mi) total length and 22.5 m (74 ft) width, is the longest bridge in Bangladesh, and is the longest over Ganges in terms of both span and the total length. The highest depth of pile of this bridge is 122 metres, which is highest among all other bridges.

About Padma Multipurpose Bridge

Jamuna Bridge

Bangabandhu Bridge, also known as the Jamuna Multipurpose Bridge is a bridge opened in Bangladesh in June 1998. It connects Bhuapur on the Jamuna River’s east bank to Sirajganj on its west bank.

It was the 11th longest bridge in the world when constructed in 1998 and at present is the 6th longest bridge in South Asia. The Jamuna River, which it spans, is one of the three major rivers of Bangladesh, and is fifth largest in the world in discharge volume.

The bridge is supported on tubular steel piles, driven into the river bed. Sand was removed from within the piles by airlifting and replaced with concrete. Out of the 50 piers, 21 piers are supported on groups of three piles and 29 piers on groups of two piles. The driving of 121 piles started on October 15, 1995, and was completed in July 1996.

About Jamuna Multipurpose Bridge

| Official name | Bangabandhu Bridge |

| Design | Box girder bridge |

| Total length | 4.98 km |

| Width | 18.5 m |

| Opening | June 1998 |

Hardinge Bridge

Hardinge Bridge is a steel railway truss bridge over the Padma River located at Ishwardi, Pabna and Bheramara, and Kushtia in Bangladesh. It is named after Lord Hardinge, who was the Viceroy of India from 1910 to 1916. The bridge is 1.8 km (1.1 mi) long.

Construction of the through truss bridge began in 1910, though it was proposed at least 20 years earlier. It was constructed by Braithwaite and Kirk Company based on design of Sir Alexander Meadows Rendel. It was completed in 1912, and trains started moving on it in 1915.

The construction of a railway bridge over the Padma was proposed in 1889 by the Eastern Bengal Railway for easier communication between Calcutta and the then Eastern Bengal and Assam. In 1902, Sir FJE Spring prepared a report on the bridge.

About Hardinge Bridge

| Official name | Hardinge Bridge |

| Design | Truss bridge |

| Total length | 1,798.32 m |

| Opening | 4 March 1915 |

Lalon Shah Bridge

Lalon Shah Bridge, locally known as Pakshey Bridge is a road bridge in Bangladesh over the river Padma, situated between Ishwardi Upazila of Pabna on the east, and Bheramara Upazila of Kushtia on the west. Named after early 19th-century mystic poet Lalon Shah of Chhewuriya, Kushtia District, the bridge was completed in 2004.

The bridge is 1,800 metres (5,900 ft) long and is the second longest road bridge of the country, after Bangabandhu Bridge. It is on the N704. It provides important road connection to Mongla port of Khulna District in the south from Rajshahi division and Rangpur division, the northern part of Bangladesh

About Lalon Shah Bridge

| Official name | Lalon Shah Bridge |

| Design | Box girder bridge |

| Total length | 1.8 km (1.1 mi) |

| Width | 18.10 m (59.4 ft) |

| Opening | 18 May 2004 |

Muktarpur Bridge

Muktarpur Bridge is a road bridge in Bangladesh. It is also known as the Sixth Bangladesh-China Friendship Bridge. Sixth Bangladesh-China Friendship Bridge It is an important bridge for Munshiganj district.

Built over the Dhaleshwari river at Muktarpur, about 4 km from Munshiganj district headquarters, this bridge is an important milestone in the communication system of Dhaka, Narayanganj and Munshiganj.

Before the bridge was built, people in the area used to cross the river in trawlers and ferries. The construction of the 1521 m long Muktarpur Bridge over the Dhaleshwari River on the Dhaka-Munshiganj road was completed in February 2008 with the aim of establishing a direct link between Dhaka and Munshiganj districts.

The bridge is 1521 meters long and 10 meters wide. The construction of the bridge has cost Tk 208.35 crore. Of this, Government of Bangladesh financed Tk 79.15 crore and project assistance Tk 129.20 crore. Construction of the bridge was completed in January 2008.

The bridge has a total of 37 spans and 126 piles. The bridge was built by a joint venture of Bangladesh Bridge Authority and China Road and Bridge Corporation. With the construction of the bridge, it has become possible to easily transport vegetables, fruits and other agricultural products from Munshiganj and its adjoining areas to Dhaka metropolis.

About Mukterpur Bridge

| Official name | 6th Bangladesh-China Friendship Bridge |

| Design | Box girder |

| Total length | 1,521 meters (4,990 ft 2 in) |

| Width | 10 meters (32 feet 10 inches) |

| Height | 18.29 m (60 ft in) |

| Total spans | 37 |

| Construction end | January 2008 |

| Construction cost | 208.35 crore |

| Opening | 18 February 2008 |

Bekutia Bridge

Bekutia Bridge is a road bridge in Bangladesh which is being constructed on the Kacha river in Pirojpur district. The bridge is being built with the help of the Chinese government. The total cost of construction of the bridge has been estimated at Tk 898 crore. Of this, the Chinese government has given a grand grant of Tk 654 crore.

The Bangladesh government has provided the remaining Tk 244 crore. The length of the bridge including the 429 meter viaduct is 1,427 meters and the width is 10.25 meters. The length of the main bridge is 998 meters.

The box girder type bridge stands on 10 pillars and 9 spans. There are 7 spans of 9 122 meters and 2 spans of 72 meters. The construction work of the bridge started in July 2016.

About Bekutia Bridge

| Official name | Bekutia Bridge |

| Design | Box girder bridge |

| Total length | 1,427 m (4,682 ft) |

| Width | 10.25 m (33.6 ft) |

| Construction begins | July 2018 |

Payra Bridge

Payra Bridge is a road bridge in Bangladesh that is built over the Pigeon River. The length of the bridge is 1,470 meters. Since the construction of this bridge, the need for ferry crossing on the 111.5 km journey from Barisal to Kuakata has been eliminated.

The Payra Bridge was built over the Pigeon River in the Lebukhali area of Dumki Upazila in Patuakhali on the Dhaka-Barisal-Patuakhali-Kuakata Highway. This bridge connects Barisal district and Patuakhali district of southern Bangladesh.

This bridge is important in connecting the roads between Patuakhali and the capital Dhaka. The bridge was opened to traffic on 24 October 2021. On 19 March 2013, Prime Minister Sheikh Hasina visited Patuakhali and laid the foundation stone of a four-lane Payra Bridge at the ferry terminal on the south bank of the Pigeon River at Lebukhali.

The project cost Tk 1,447.24 crore, which is three and a half times more than the original cost. The construction was funded by the Kuwait Fund for Arab Economic Development and the OPEC Fund for International Development.

About Payra Bridge

| Official name | Payra Bridge |

| Design | Box girder bridge |

| Total length | 1,470 m (4,820 ft) |

| Width | 19.76 m (64.8 ft) |

| Height | 18.30 m (60.0 ft) |

| Construction start | July 2016 |

| Construction end | October 2021 |

| Opening | 24 October, 2021 |

Khan Jahan Ali Bridge

Khan jahan Ali Bridge is a bridge built over the river Rupsha. It is also known as Rupsha Bridge. The special feature of this bridge is that it has a total of four steps, two at each end, with the help of which the main bridge can be climbed. Every day a lot of visitors come to visit the bridge.

The distance of bridge from Rupsha in Khulna city is 4.80 km. This bridge can be called the gateway of Khulna city because this bridge has established road connection with Khulna in the southern districts especially with Mongla seaport. The length of the bridge is about 1.60 km. And its width is 16.48 meters.

The bridge has special lanes for pedestrians and non-pedestrian vehicles. At present it has become a place of interest in Khulna. Khulna city looks very beautiful from the bridge at night. During the festival days, young people flock to this bridge and rejoice.

The foundation stone of the Japanese-built bridge was laid by the then Prime Minister Sheikh Hasina and inaugurated by former Prime Minister Begum Khaleda Zia.

About Khan Jahan Ali Bridge

| Official name | Khan Jahan Ali Bridge |

| Total length | 1.60 km |

| Width | 16.48 m |

| Opening | 21 May, 2005 |

Syed Nazrul Islam Bridge

Syed Nazrul Islam Bridge is a road bridge over the river Meghna between Bhairab and Ashuganj. This bridge plays a role in the development of Dhaka’s communication with Sylhet in the north-eastern region of Bangladesh. This bridge is part of Dhaka-Sylhet highway. The Bhairab Railway Bridge is located next to this bridge.

The Bhairab Bridge is located on the Meghna River. Construction of the bridge began in 1999 and was completed in 2002. The construction of the bridge cost Tk 635 crore. At first this bridge was named as Bangladesh-UK Friendship Bridge. Later in 2010, its name was changed to Syed Nazrul Islam, one of the four national leaders.

The main bridge is 1.2 km long and 19.60 m wide. It has seven 110 m spans and two 79.5 m spans. It is a toll bridge, the bridge authority collects tolls from vehicles crossing.

About Syed Nazrul Islam Bridge

| Official name | Syed Nazrul Islam Bridge |

| Total length | 1,200 m (1.2 km) |

| Width | 19.60 m |

| Opening | 2002 |

Shah Amanat Bridge

Shah Amanat Bridge or Third Karnafuli Bridge is the third bridge built over the river Karnafuli. The construction work of this bridge started on 8 August 2007 and was completed in 2011. The launch of the bridge not only helped in the development of industries in the industrial areas on the south bank of the river Karnafuli, but also opened new horizons in the tourist towns of Bandarban and Cox’s Bazar.

The length of Shah Amanat Bridge or 3rd Karnafuli Bridge is 950 meters, width is 24.40 meters which means it is a 950 meter long cable stand anta dose concrete bridge which is suitable for heavy vehicles. The main bridge with charlane, footpath and divider is 830 meters.

The total number of pillars of the bridge is 10. There are four in the middle of the river, six on the north and south sides of the bridge. The connecting road of this four lane bridge is equally wide. Computerized controlled toll is collected on this bridge. The construction of the bridge was completed in less than four years.

The construction work of the bridge has been completed by the Chinese engineering company China Major Bridge Company at a cost of Tk 490 crore. It connects Patia and Bakalia police stations. More than Tk 100 crore has been saved in the implementation of this project.

About Shah Amanat Bridge

| Official name | Shah Amanat Bridge |

| Design | Randall Ltd. |

| Total length | 950 m (3,117 ft) |

| Opening | 6 September, 2010 |

Thank you for reading this article Economically Important Bridges in Bangladesh. If you have more information about Economically Important Bridges in Bangladesh just comment us bellow. Economically Important Bridges in Bangladesh, Economically Important Bridges in Bangladesh, Economically Important Bridges in Bangladesh, Economically Important Bridges in Bangladesh, Economically Important Bridges in Bangladesh.

Economically important bridges in Bangladesh, Economically Important Bridges in Bangladesh, Major bridges in Bangladesh, Economically Important Bridges in Bangladesh, Important bridges for Bangladesh economy, Economically Important Bridges in Bangladesh, List of important bridges in Bangladesh, Economically Important Bridges in Bangladesh, Famous bridges in Bangladesh, Economically Important Bridges in Bangladesh, Largest bridges in Bangladesh, Economically Important Bridges in Bangladesh, Longest bridges in Bangladesh, Economically Important Bridges in Bangladesh, Key bridges in Bangladesh transport system, Economically Important Bridges in Bangladesh,

]]>A bridge is a structure built to span a physical obstacle without blocking the way underneath. It is constructed for the purpose of providing passage over the obstacle, which is usually something that is otherwise difficult or impossible to cross.

Bridges are not merely structures of steel and stone; they are vital arteries of communication, commerce, and culture. In Bangladesh, a land crisscrossed by rivers, bridges have played a crucial role in shaping the country’s history, economy, and connectivity. Among the hundreds of bridges that span its waterways, a select few hold historical significance due to their age, architectural merit, and cultural value. These historical bridges are not only engineering marvels of their time but also enduring symbols of resilience and progress.

This article explores the most iconic historical bridges in Bangladesh, shedding light on their background, construction, architectural features, and impact on regional development. Whether built during the British colonial era or the early years of independent Bangladesh, these bridges narrate tales of engineering ingenuity and strategic importance.

Top 7 Historical Bridges in Bangladesh

Bangladesh, known as the “Land of Rivers,” has more than 700 rivers flowing through its territory. With such an intricate network of rivers and waterways, bridges are essential for maintaining communication and transportation. Before modern roadways and expressways, bridges were lifelines connecting distant parts of the country, enabling trade, governance, and cultural exchange.

Historical bridges, in particular, served as the foundation for infrastructural development during the colonial period and continue to be relevant even today. They also symbolize the socio-political transitions that occurred during the British Raj, the Pakistan period, and the eventual independence of Bangladesh in 1971.

Hardinge Bridge | Historical Bridges in Bangladesh

- Location: Paksey, over the Padma River

- Constructed: 1910-1915

- Designer: Sir Alexander Meadows Rendel

- Type: Steel truss bridge

- Length: Approximately 1.8 kilometers

Hardinge Bridge is arguably the most iconic historical bridge in Bangladesh. Constructed during the British colonial era, it was named after Lord Hardinge, the then Viceroy of India. It was designed to connect the Calcutta (now Kolkata) rail network with Assam and North Bengal, thereby facilitating the movement of goods and people.

The bridge was inaugurated in 1915 and features steel truss construction, which was cutting-edge at the time. Despite over a century of use and exposure to natural elements, the bridge remains functional and continues to support railway traffic.

Significance:

- Facilitated trade between East and West Bengal.

- One of the earliest large-scale infrastructure projects in the Indian subcontinent.

- Symbolizes colonial ambition and engineering excellence.

Keane Bridge | Historical Bridges in Bangladesh

- Location: Sylhet, over the Surma River

- Constructed: 1936

- Named After: Sir Michael Keane, the then Governor of Assam

- Type: Steel arch bridge

Often referred to as the “Gateway to Sylhet,” Keane Bridge is one of the oldest and most recognized landmarks in Sylhet. Built during British rule, the bridge was intended to improve access to the Sylhet region, known for its tea estates and hilly terrain.

Its steel arch design is both aesthetically pleasing and structurally robust. The bridge was partially damaged during the Liberation War of 1971 but was later restored to its original form.

Significance:

- Connects Sylhet city with surrounding rural areas.

- A symbol of colonial architectural legacy.

- Frequently featured in local art and literature.

Loharpul Bridge | Historical Bridges in Bangladesh

- Location: Narayanganj, over the Shitalakshya River

- Constructed: 1885

- Type: Iron bridge

Loharpul Bridge is one of the earliest iron bridges in Bangladesh. Located in Narayanganj, it was built to support the thriving jute trade during the British era. Narayanganj was a major commercial hub, and the bridge played a crucial role in transporting goods to and from the port.

Despite its age, the bridge is still in use and stands as a testament to the engineering methods of the 19th century.

Significance:

- Facilitated economic growth in Narayanganj.

- Example of 19th-century British engineering in South Asia.

- Cultural and historical landmark.

Bhairab Railway Bridge | Historical Bridges in Bangladesh

- Location: Bhairab Bazar, over the Meghna River

- Constructed: 1937

- Type: Steel truss railway bridge

The Bhairab Railway Bridge was constructed to enhance railway connectivity between Dhaka and the eastern regions of Bengal. The bridge spans the Meghna River and remains a vital component of the railway network in Bangladesh.

Over the years, a new parallel bridge was constructed to support increased traffic, but the original Bhairab Bridge still holds historical significance.

Significance:

- Key railway corridor for freight and passenger transport.

- Enhanced regional connectivity.

- Represents colonial infrastructure expansion.

Teesta Railway Bridge | Historical Bridges in Bangladesh

- Location: Lalmonirhat District, over the Teesta River

- Constructed: Early 20th century

- Type: Steel railway bridge

The Teesta Railway Bridge played a vital role in connecting the northern districts of Bangladesh. It was part of the railway expansion during the British period and served as a key link for transporting agricultural produce.

Although newer bridges have reduced its utility, the Teesta Railway Bridge remains an important part of the region’s history.

Significance:

- Promoted agricultural trade.

- Strengthened colonial governance through better connectivity.

- Historical importance in North Bengal.

Anderson Bridge | Historical Bridges in Bangladesh

- Location: Kishoreganj, over the Narsunda River

- Constructed: 1930s

- Named After: British engineer Anderson

- Type: Steel truss bridge

The Anderson Bridge in Kishoreganj was built to facilitate movement in and out of the district. It features a steel truss design and is among the lesser-known yet historically significant bridges in Bangladesh.

Significance:

- Supported administrative mobility during British rule.

- Remains a local landmark.

- Reflects engineering techniques of the early 20th century.

Victoria Bridge | Historical Bridges in Bangladesh

- Location: Pabna, over the Ichhamati River

- Constructed: Late 19th century

- Named After: Queen Victoria

Victoria Bridge is another relic from the British colonial era. Though not as large as Hardinge Bridge, it was vital for local connectivity and economic activity in the Pabna region.

Significance:

- Named to honor British monarchy.

- Symbolizes British presence in rural Bangladesh.

- Facilitated local trade and movement.

Preservation and Challenges

Many of these historical bridges face the risk of decay due to aging infrastructure, lack of maintenance, and increasing traffic loads. Urbanization and climate change have also contributed to their vulnerability. While some bridges have been restored and preserved, others remain in dire need of attention.

Government initiatives, local heritage groups, and civil engineers have emphasized the need to conserve these architectural treasures. Restoring these bridges not only preserves history but also promotes cultural tourism.

Conclusion

Historical bridges in Bangladesh are more than just old structures; they are enduring symbols of the country’s journey through time. From the colonial-era marvels like Hardinge Bridge to the lesser-known yet historically rich structures like Anderson and Victoria Bridges, these engineering feats have played crucial roles in shaping the socio-economic and cultural landscape of the country.

Preserving them is essential not only for their historical and architectural value but also for fostering a deeper understanding of the nation’s past. As Bangladesh continues to modernize its infrastructure, these bridges serve as important reminders of how far the nation has come—and the foundation upon which its future is built.

]]>A contributor will get lifetime pension benefits from the age of 60 years if he joins the pension program or scheme. But if the contributor dies, his nominee or heir will get the pension. However, in this case, the nominee can withdraw the pension till the age of 75 years of the contributor.

Currently four types of schemes have been introduced under the universal pension. Among them there are Pravas scheme for expatriates, Pragati scheme for private employees, Protection scheme for citizens engaged in informal sector i.e. self-employed and Samata scheme for low income people.

Public Pension Scheme Regulations have already been issued to implement these programmes; And Public Pension Authority has been formed. Besides, a website named ‘Upension‘ has been launched. Anyone can join the pension program from today through this website.

Universal Pension: How to Apply From Online

- Vist Official Website

- Click Registration

- Fill all Process

Important Information for Universal Pension bd

- Anyone can nominate one or more people if they want.

- In addition to the monthly subscription, one can pay the full subscription every three months or once a year.

- In case of failure to pay the subscription within the due date, the subscription can be paid without penalty till the next month. 1% late fee will be added for every day thereafter.

- If one does not pay 3 installments in a row, his account will be suspended. However, if one declares himself insolvent, the account will not be suspended even if the contribution is not paid for up to 12 months.

- Subscription can be paid online and through any mobile banking service.

Probash

This is only for Bangladeshi citizens working or staying abroad. Its monthly subscription rate has been fixed at 5 thousand, 7.5 thousand and 10 thousand taka. If the person wants, he can pay the amount equivalent to this contribution in the currency of the country he is in. You can also pay in local currency when you come back to the country. Besides, if necessary, there is an opportunity to change the immigration scheme.

Progoti

This scheme is for the employees of private companies. In this case too, the subscription rate has been divided into three parts. Anyone can participate in this scheme by paying 2 thousand, 3 thousand or 5 thousand rupees per month.

Again the organization or the owner of the organization can also participate in the Pragati scheme. In that case, half of the total contribution will be borne by the employee and the other half by the institution.

Surokha

This scheme is for self dependent person. That is, someone who is not employed anywhere but can earn himself, they can participate in the protection scheme. Freelancers, farmers, laborers etc. come under this. There are four types of subscription rates in this scheme – 1000, 2000, 3000 and 5000 taka per month.

Somota

The subscription rate in this scheme is one – one thousand rupees. However, in this case, the individual will pay five hundred taka per month and the remaining five hundred will be given by the government. This scheme is mainly for low income people living below poverty line.

In this case, Bangladesh Bureau of Statistics will determine the poverty line. For example, only those whose annual income is now between 60 thousand rupees per annum will be included in this scheme.

Who is this Universal Pension bd scheme for?

The National Pension Authority says that this pension system has been introduced to benefit all the people of the country. In particular, the aging population is increasing due to the increase in average life expectancy. As a result, their social security will be provided by the universal pension system.

Bangladeshi citizens of all professions between the ages of 18 to 50 can participate in this scheme according to their National Identity Card. In other words, national identity card is required to be a part of public pension scheme.

However, there is an exception for expatriate Bangladeshis, who do not have a national identity card, they can register with a passport if they want, but in that case, the national identity card must be collected and submitted as soon as possible.

Again, special consideration has been given in terms of age. Those who have crossed the age of 50 can also participate in the universal pension scheme. But in that case he will get pension after 10 consecutive years of contribution.

That is, according to the scheme, the person will start getting pension from the government only when he is 60 years old, he will not have to pay any more contribution. But if one reaches the age of 55 and participates in the scheme then he will start getting pension from the age of 65.

The government has announced a total of 6 schemes. However, four schemes have been launched for now. These are named immigration, progress, protection and equality.

]]>Whether you’re considering a home construction loan, apartment purchase, or renovation, it’s important to compare rates, terms, and offers to find the most affordable solution. Stay informed with the latest home loan interest rates in Bangladesh to ensure you secure the best deal for your property investment.

Bangladesh Home Loan Interest Rate 2025

Now we will say about the top 10 banks in Bangladesh. The bank’s home loan has already good responded to customers. These banks have become a dependency to the customers. Here is your Home loan Interest Rate by the table.

| Bank Name | Rate | Max Loan | Max Tenue |

|---|---|---|---|

| AB Bank | 14-16% | 2 Crore | 20 Years |

| Agrani Bank | 13.40% | 2 Crore | 20 Years |

| Al-Arafah Islami Bank | 14%. | 2 Crore | 20 Years |

| Bangladesh Commerce Bank | 9% | 5 Lack | 36 Months |

| Bangladesh Development Bank | 13.69% | ||

| Bank Asia | 12.55 – 14.55% | 2 Crore | 20 Years |

| BASIC Bank | 9.00% | 2 Crore | 20 Years |

| Bengal Commercial Bank | 14% | 2 Crore | 20 Years |

| BRAC Bank | 10.1% | 25 Lack | 20 Years |

| City Bank | 9% | 2 Crore | 25 Years |

| Community Bank Bangladesh | 2 Crore | 25 Years | |

| Dhaka Bank | 2 Crore | 25 Years | |

| Dutch-Bangla Bank | 2 Crore | 25 Years | |

| Eastern Bank | 2 Crore | 25 Years | |

| Exim Bank | 13.50% | 2 Crore | 25 Years |

| First Security Islami Bank | 14.50 – 16.50% | 2 Crore | 20 Years |

| Global Islami Bank | 15% | 1 Crore | 20 Years |

| ICB Islamic Bank | 9 – 13.55% | 2 Crore | 20 Years |

| IFIC Bank | 2 Crore | 25 Years | |

| Islami Bank Bangladesh | 12% | 2 Crore | 25 Years |

| Jamuna Bank | 2 Crore | 20 Years | |

| Janata Bank | |||

| Meghna Bank | 2 Crore | 25 Years | |

| Mercantile Bank | 2 Crore | 25 Years | |

| Midland Bank | 2 Crore | 25 Years | |

| Modhumoti Bank | 2 Crore | 25 Years | |

| Mutual Trust Bank | 2 Crore | 25 Years | |

| NCC Bank | 2 Crore | 20 Years | |

| NRB Bank | |||

| NRBC Bank | 2 Crore | 20 Years | |

| ONE Bank | 14% | 2 Crore | 25 Years |

| Premier Bank | 15% | 2 Crore | 25 Years |

| Prime Bank | 10.50 – 12.50% | 2 Crore | 25 Years |

| Pubali Bank | 2 Crore | 25 Years | |

| Rupali Bank | 120 Lack | 15 Years | |

| Shahjalal Islami Bank | 2 Crore | 20 Years | |

| Social Islami Bank | 2 Crore | 25 Years | |

| Sonali Bank | |||

| Southeast Bank | 12.50% | 2 Crore | 25 Years |

| Standard Bank | 2 Crore | 20 Years | |

| Trust Bank | 2 Crore | 25 Years | |

| UCB Bank | 2 Crore | 25 Years | |

| Uttara Bank | 75 Lack | 15 years | |

| Union Bank | 8.60% |

Bangladesh Home Loan Interest Rate Basic Info

Finally, we tell you Bangladeshi popular Bank’s Details information. These banks have already gained popularity. These banks provide regular home loans 7 here you get Home loan Interest Rate latest information’s.

Islami Bank Bangladesh Limited

Islami Bank Bangladesh Limited is a Joint Venture Public Limited Company engaged in commercial banking business based on Islamic Shari’ah with 63.09% foreign shareholding having largest branch network ( total 346 Branches) among the private sector Banks in Bangladesh.

It was established on the 13th March 1983 as the first Islamic Bank in South East Asia. It is listed with Dhaka Stock Exchange Ltd. and Chittagong Stock Exchange Ltd. Authorized Capital of the Bank is Tk. 20,000 million and Paid-up Capital is Tk. 16,099.91 million having 33,686 shareholders as on 31st December 2018.

| Nature of Goods / Items | Construction of the building, purchase of flats / ready-made building, extension/renovation of a house, installation of a lift, generator, substation, etc. |

| Mode of Investment | Bai-Muajjal / HPSM |

| Period of Investment | Maximum 15-years |

| Rate of Return | 15.00% |

| Bank’s Participation | 60% for construction & 50% of the cost price for purchasing flat (but not exceeding Tk.7.50 million) |

| Age of Clients | Maximum 65-years. |

Amount of Investment

- For Construction, up to 60% but not to exceed Tk.10.00 million

- purchase of Flat / Apartment up to 50% but not to exceed Tk.7.50 million.

- purchase of Ready-made House, up to 50% but not to exceed Tk. 10.00 million.

Security

- Registered mortgage on land / building / flat, Personal Guarantee(s), MSS / TDR as additional security etc.

How to Apply

- Application Form shall have to be collected from the nearest Branch of Islami Bank Bangladesh Ltd.

Brack Bank Limited

BRAC Bank‘s Retail Banking division, established in the year 2001, provides a wide suite of products and services to cater to a multitude of retail loan requirements. The division provides home loans and car loans in addition to a wide range of other personal loans, credit cards, and cash-secured loans.

Leveraging BRAC Bank’s robust pan-Bangladesh network, the bankâ€ s Retail Banking division enjoys strong penetration across the country, facilitating both marketing of retail loan products as well as collections. The division also possesses robust credit appraisal standards and procedures with industry-leading TAT (loan turnaround time), which stood at an average of 2 days in2017.

s Retail Banking division enjoys strong penetration across the country, facilitating both marketing of retail loan products as well as collections. The division also possesses robust credit appraisal standards and procedures with industry-leading TAT (loan turnaround time), which stood at an average of 2 days in2017.

Salaried Individuals

- Total job experience s minimum of 3 years & must be permanent in the current job

Minimum income is BDT 25000 - Salaried Individuals Total job experience s minimum of 3 years & must be permanent in current job Minimum income is BDT 25000

Documents

- Latest 1-year personal bank statement

- Latest Tax clearance certificate /return receipt of tax*

- Photocopy of National ID Card / Passport

- Letter/ Allotment Agreement/ Byna Deed for Home Loan

- Registered ownership deed for Home Credit / Take Over Loan

- Price quotation for Home Credit Loan

- Letter of introduction (LOl)

- Latest 01-year salary account statement

Businessmen / Self Employed individuals / Landlords

- Owner / Director of Proprietorship / Partnership / Private Limited Company

- Total business experience is a minimum of 3 years

- Minimum income is BDT 30000

Eastern Bank

EBL introduces the most convenient & practical Home Loan that suits your all home financing needs. Let it be for apartment purchase, home construction, extension or renovation – EBL is here with the ultimate solution for you.

With so many attractive features in it – the home you wanted to buy or to extend the existing one or renovate the same is no longer a distant dream.

Features

- Home Loan for the purpose of Flat/Apartment Purchase/House construction / Extension / Renovation / Up-gradation/ Face uplifting / Finishing work

- The takeover of existing home loan from any bank / Financial institution

- Loan Amount Ranges from BDT 500,000 to BDT 12,000,000 or 70% of the property value whichever is lower

- Competitive interest rate

- No Processing fee for Taking over home loans from other Banks/ Financial Institutions

- Repayment tenure of up to 25 years

- Automatic realization of Monthly Installments

- The early full and partial settlement allowed

- Shortest Loan Processing Time

Age

- Minimum: 25 Years

- Maximum: 65 years

- Minimum Gross Monthly Income:

Salaried Executives: BDT 30,000

Professionals/Self Employed: BDT 40,000

Businessman: BDT 50,000 - Joint applicant allowed ( spouse and immediate family member);

- Combined Gross monthly income should be minimum BDT 40,000 per month.

Property Features

- Loan facility for both Leasehold and freehold properties.

- TPA (Tri Partite Agreement) allowed for up to 18 months from the date of the loan disbursement

Jamuna Bank

Jamuna Bank Limited (JBL) is a Banking Company registered under the Companies Act, 1994 of Bangladesh with its Head Office currently at Hadi Mansion, 2, Dilkusha C/A, Dhaka-1000, Bangladesh. The Bank started its operation from 3rd June 2001.

Customer Segment

For permanent/confirmed service holders of Govt., Semi-Govt., Autonomous Organizations, Banks, Insurance Companies, Public Limited Companies, Multinational Companies, NGOs, Employees of Private Limited Companies, acceptable to the bank, covered by a guarantee of another employee of an equal or higher grade. Teachers of Universities, Colleges & Schools (Affiliated). Professional persons like Doctors, Engineers, Chartered Accountants, and Architects.

| Purpose | For construction & renovation of residential house/building and purchase of Flat/Apartment & any lawful purpose. |

| Minimum Income | Net Income should be at least Tk. 40,000/- per month. (To be substantiated by evidence) |

| Loan Size | Minimum 2.00 Lac and Maximum Tk. 50.00 Lac. |

| Maximum Term of Loan | 10 years. |

| Loan to price | Regulated by Bangladesh Bank from time to time. |

| Rate of Interest | As determined by the bank from to time. |

Nationality & Age Limit

- Bangladeshi by birth.

- Minimum age 25 years / Maximum age 55 years.

- Loan tenor shall not exceed 60 years of age.

Security/ Collateral

- The loan shall be secured by 200% tangible asset or 100% financial asset.

- In suitable cases, the security condition may be relaxed.

- Hypothecation/ Lien / Registration / Mortgage of any other asset, acceptable to the bank, as feasible depending on the type of asset.

- Personal guarantee of the applicant & applicantâ€

s spouse.

s spouse. - Third-party guarantor shall be equal to or creditworthy than the principal applicant.

Midland Bank

The Company was incorporated on March 20, 2013, under the Companies Act 1994 as a public company limited by shares for carrying out all types of banking activities with Paid-up Capital of Tk. 400,00,00,000 divided into 40,00,00,000 ordinary shares of Tk.10 each.

| Age | 21 Years – 62 years (For Salaried), 65 Years (For Others) (at the end of loan tenor) |

| Tenure | Maximum 20 (Twenty) years |

| Highest Amount | Bank will finance a maximum 70% of property value or BDT 1.20 crore whichever is lower |

Feature

- Home Loan for the purpose of : Flat/Apartment Purchas/House Construction / Renovation / Extension / Completion

- The takeover of existing home loan from any Bank / Financial Institution Loan Amount ranges from BDT 500,000 to BDT 12,000,000

- Repayment tenure of 3 years to 20 years

- Competitive interest rate

- No Processing fee for Taking over home loans from other Banks/ Financial Institutions

- Early full settlement and partial settlement allowed

Minimum Gross Monthly Income

- Govt. Employees: Minimum BDT 40,000 per Month

- Salaried Exec. : Minimum BDT 50,000 per Month

- Professionals/Businessperson: Minimum BDT 50,000 per Month

NCC Bank

Housing is one of the five prime needs of mankind. Everybody has a dream to have a dwelling house of his own. NCC Bank‘s Housing Loan with competitive rates, convenient features, and simple procedures will enable you to turn your dream into reality.

Purpose of the loan

- Purchases of Flats/Houses

- Construction of building on own land

- Extension of building/floors

Who can apply

- Confirmed Service holders with at least 3-years service experience employed by a well-reputed organization

- Professionals with minimum 3-years experience (with adequate proof)

- Businesspersons with minimum 3-years continuous business performance (with adequate proof).

Feature of the loan

- Loan Amount: Tk.5,00000/-to Tk.75,00000/.

- Loan Period: 05 years to 15 years

- Interest Rate: Competitive Interest Rate as per Bank’s Policy and Bangladesh Bank

- Age of the property: Not exceeding 10 years in case of purchase of ready house/building

- Location of the property: City Corporation/Pourosava where there is a plan duly approved by a designated graduate Civil Engineer duly approved by the appropriate authority

One Bank Limited

OBL Home Loan is an attractive solution for your home financing need. Fulfill your dream by our Home Loan with affordable and flexible features. From apartment purchase to construction, renovation or transferring your existing home loan with other Banks/Financial institutions, we are always ready to finance.

Features

- Loan amount ranges from BDT 5,00,000/- to BDT 1,20,00,000/-

Repayment Tenure

- New Flat/Construction: Maximum 25 years

- Old Flat/House: Maximum 20 years

- Renovation Purpose: Maximum 15 years

Interest rate

- Regular Loan 11.99%

- Takeover Loan 10.99%

- Minimal documentation

- Take over the facility from another bank/financial institutions

- Processing fee waiver on takeover loan

Eligibility

- Any creditworthy individual having age from 18 to 70 years or retirement age whichever is earlier at loan maturity.

Professional Experience

- Salaried: Regular/Permanent employee with a minimum of 1 year of total experience and minimum

- 6 months with present employer

- Professionals: Minimum 2 years of practice in the respective profession

- Business Individuals: Minimum 2 years of business establishment

- Remittance Earner: Having remittance income for at least 1 year through legitimate channel

Minimum Gross Monthly Income

- BDT 50,000/-

City Bank Plc

From 1983 till date, City Bank has been a case study in evolution, has transformed over time from a traditional organization to a critically acclaimed multi-faceted institution that embraces global best practices and chooses to be at the forefront of technological initiatives.

Unlike many, the Bank’s criteria for success are not only the bottom-line numbers but also the milestones set towards becoming the most complete bank in the country.

Features

- Loan amount ranging from BDT 5 lac to BDT 120 lac

- Repayment tenure 1 year to 25 years

- Financing up to 70% of property value

- Early settlement facility

- No hidden cost

- Phase disbursement facility

- Loan across the country

Processing Fee

- 1% processing fee on any loan amount

- No processing fee on Takeover and enhancement facilities

Eligibility

- Age: 22 to 65 years

- Experience: 3 years of experience in the respective field.

Income criteria

- BDT 50,000 and above

- BDT 30,000 (Government officials only)

Trust Bank

Trust Bank Limited is one of the leading private commercial banks having a spread network of 111branches & SME centers, 222 ATM Booths, over 20,000 Pay points and 65 POS in 55 Branches across Bangladesh and plans to open more branches to cover the important commercial areas in Dhaka, Chittagong, Sylhet and other areas in 2018.

| Loan Limit | Maximum BDT 1 crore. |

| Tenure | 1 year’s to 25 Years |

| Interest Rate | 11.5% |

| Minimum Down Payment | 30% (House/ apartment Purchase) 40% (Construction of New House) |

| Customer Segments | Salaried Personnel, Self-employed Professional, Business Person, Landlord/ Landlady |

| Age | 25 Years to 65 Years |

| Age of the property | Max. 20 years old at the time of underwriting. Age of the property should not more than 40 years at the end of the loan tenure. |

Purpose

- Purchasing residential property

- Construction of new residential house(s)

- Taking over of House Building Loans from other Banks/Non-Banking Finance Institutions

- Extension, Renovation/ Modification, Finishing Work of residential property

UCB Bank

The Bank, aiming to play a leading role in the economic activities of the country, is firmly engaged in the development of trade, commerce and industry by investing in network expansion and new technology adoption to have a competitive advantage.

Features

- Maximum loan amount of up to BDT 1.20 crores

- Flexible repayment tenure of up to 25 years

- Attractive variable interest rate and fees

- No hidden charges

- Fast approval process

- Loan disbursement during the construction stage

- Disbursement against the tripartite agreement and registered mortgage

- Loan top-up and takeover facility

- Loan facility for Non-Resident Bangladeshis (NRB)

Who are eligible?

- Salaried executives, businesspersons and self-employed individuals with minimum 3 years of experience

- Applicant or applicants must have a minimum aggregate income of:

- Salaried customers: BDT 40,000

- Self-employed professionals: BDT 60,000

- Businessmen & Landlords: BDT 75,000

- Non Resident Bangladeshis (NRB): BDT 80,000 equivalent

- The loan applicant must be at least 25 years of aged.

Which eligibility required?

Eligibility can vary from one lending institution to another, but there are some common requirements-

- Any salaried, self-employed or business person with Bangladeshi nationality can apply for a home loan

- You must be 21 years or older.

- You should have a regular source of income to pay off your loan periodically.

- Your professional durability and savings history will help with the fast loan approval.

- Before applying for a home loan, be aware that you have no bad credit history until at least three months in advance.

- If you are a salaried professional, your monthly gross income will determine the loan amount.

- Profit earned for self-employed individuals is primarily determined by the value of the loan.

Your income?

The most important thing about getting a home loan is your monthly income. Based on which the bank will give you a loan. If your income is fixed every month, it will be easier to get a bank loan. Because the thing that the bank will check before giving you a loan is whether you can pay the loan properly.

Whether you are in debt?

The second thing that the bank puts special importance before giving you a loan is whether you are involved in any type of loan. The bank will take a good idea about your bank balance and bank history before giving you a loan.

For those who use credit cards, the bank will decide on a loan with a clear idea of your credit balance. If you think that your credit balance duo will not be too much of an issue then you are totally wrong. Credit card dew will have a very bad effect on your loan.

Your age?

One of the main things you should age when it comes to getting a home loan. If you are over 40 years old, the bank will think a hundred times before you give a loan. Because they cannot be guaranteed, whether you can repay the loan properly.